How The Big Beautiful Bill Impacts HVAC Tax Credits In 2026

If you’re considering upgrading your HVAC system, it is a good idea to get it done in 2025. Homeowners who want to improve their home’s heating and cooling, and take advantage of federal tax credits for installing high-efficiency heat pumps, furnaces, or air conditioners, have a chance to save money with tax credits in 2025. Major changes to federal HVAC tax credits are coming due to the passing of the “Big Beautiful Bill”, and homeowners need to understand what’s changing, when, and how it affects future projects.

If you’re considering upgrading your HVAC system, it is a good idea to get it done in 2025. Homeowners who want to improve their home’s heating and cooling, and take advantage of federal tax credits for installing high-efficiency heat pumps, furnaces, or air conditioners, have a chance to save money with tax credits in 2025. Major changes to federal HVAC tax credits are coming due to the passing of the “Big Beautiful Bill”, and homeowners need to understand what’s changing, when, and how it affects future projects.

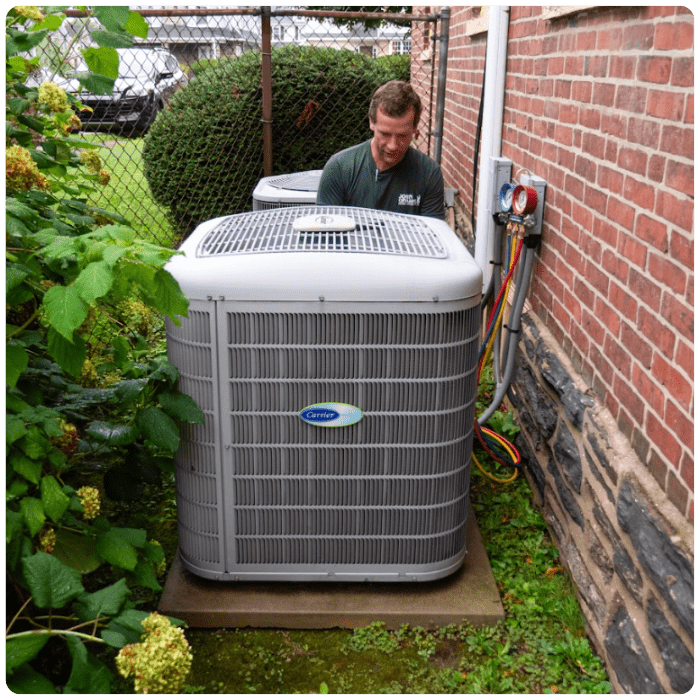

We’ve been installing the heat pumps, air conditioners, and furnaces in the area for years. Since 1953, when John Cipollone Sr. started delivering heating oil, we have taken pride in making sure our customers are comfortable in their homes. We also want to make sure that our customers are saving as much money as possible when they decide to install a new HVAC system. This is why it’s so important to know how the loss of these tax credits affects your ability to save money on a new heating and cooling system.

If you want to speak to one of our comfort consultants today, give us a call at (610) 446-7877, or contact us online. We can answer any questions you may have about tax credits and rebates for HVAC systems, and get you set up with a free HVAC system consultation.

What Is the 25C Tax Credit?

The Section 25C Energy Efficient Home Improvement Credit is a federal tax credit designed to help homeowners offset the cost of qualified energy-efficient home upgrades. It’s a nonrefundable credit, meaning it can reduce your federal tax liability but won’t result in a refund beyond your tax owed. This is what is going to end at the conclusion of 2025. But for right now, this tax credit is still valid.

Under 25C, homeowners can claim:

- Up to $1,200 annually for general energy efficiency improvements (e.g., insulation, energy-efficient windows, and doors).

- An additional $2,000 specifically for high-efficiency heat pump systems.

Eligible improvements include:

- Central air conditioners up to $600

- Gas furnaces up to $600

- Boilers up to $600

- Heat pumps up to $2000

- Certain insulation materials and exterior doors/windows

To qualify, the equipment you decide to install must meet efficiency standards set by the IRS and must be installed in your primary residence in the US. We can help you by guiding you through the systems that qualify for tax credits.

What’s Changing in Congress?

As part of the One Big Beautiful Bill Act, Congress has passed legislation that eliminates several key energy-related tax credits, including Section 25C and Section 25D, starting January 1, 2026.

Here’s a breakdown of the changes:

- Section 25C (Energy Efficient Home Improvement Credit) will expire for any project placed in service after December 31, 2025.

- Section 25D (Residential Clean Energy Credit)—which covers solar panels, geothermal heat pumps, and similar technologies—will also expire after December 31, 2025.

- Section 45L (New Energy Efficient Home Credit) will expire for homes purchased after June 30, 2026.

- Section 179D (Commercial Building Energy-Efficiency Deduction) will expire for construction projects beginning after June 30, 2026.

These changes are part of a broader Congressional effort to scale back certain provisions of the Inflation Reduction Act (IRA) related to renewable and energy-efficient technologies.

When Is the Last Effective Date to Claim 25C or 25D?

To qualify for the 25C or 25D tax credits, your equipment must be fully installed and operational (i.e., placed in service) by December 31, 2025.

Starting a project in 2025 is not enough. If installation is delayed or incomplete by the end of 2025, the system will not qualify for these federal credits, even if the equipment was purchased and work began beforehand. This is why we recommend that you act soon if you want to upgrade your HVAC equipment. Waiting until December could mean you may miss out if the project isn’t finished by the time the ball drops on New Year’s Eve!

What Types of Projects Are Included Under 25C?

Section 25C covers a wide range of home energy efficiency improvements, including:

- HVAC system replacements (heat pumps, air conditioners, furnaces, boilers)

- Insulation upgrades

- Replacement of doors and windows with ENERGY STAR® certified products

- Electric panel upgrades related to efficiency improvements

If you’re planning to replace or upgrade your air conditioner, gas furnace, or install a new heat pump, these projects must be completed and placed in service by the end of 2025 to qualify. John Cipollone Inc. specializes in AC, furnace, and heat pump installations. We can take a look at your home, and recommend the right system that fits your needs. We can also help you match the system to the best rebates and tax credits currently available.

This is especially important for anyone who may want to replace their air conditioning systems. If you want to hold off until next spring or summer, it’s likely going to end up costing you for 2 reasons. For one, the price of the system will likely rise in the next year, as most products do. Secondly, these tax credits won’t be available, giving you less of a chance to save money.

Why Are These Tax Credits Ending?

The elimination of Sections 25C and 25D is part of a Congressional reconciliation effort to scale back certain provisions of the Inflation Reduction Act (IRA). This move is intended to reduce government spending and reallocate budget priorities.

Along with 25C and 25D, credits like 45L and 179D are also ending, indicating a broader phase-out of federal energy-efficiency incentives.

This makes 2025 a critical year for homeowners and contractors to complete these projects, that way they are eligible for these tax credits before they expire! At John Cipollone Inc. we can complete projects quickly and efficiently, and will make sure your upgrade is completed in the right timeframe to claim your tax credit.

What If My Contractor Starts the Project in 2025 but Finishes in 2026?

This is a question lots of homeowners were confused about, but we have a sure answer. The IRS and Department of Energy define the eligibility date for tax credits based on the date the equipment is “placed in service,”. This means that the system must be fully installed, operational, and in use in your home.

If your system is not functioning by December 31, 2025, you will not qualify for the credit, even if installation started or the contract was signed in 2025.

To ensure eligibility, we are hoping to get most of the projects signed and started before December 1st. There are some systems that we can install in a day, but you never know what emergencies or delays can arise. Click here or give us a call to schedule a free HVAC consultation, so we can get your project started ASAP!

Does This Impact Local Utility Rebates?

No. Local utility rebate programs are not affected by the changes to federal tax credits. This means that local rebates like ones from the Electrical Association of Philadelphia (EAP), offer. We also have rebates through PECO, which are usually available most of the year.

These programs are managed independently by each utility provider and approved by state regulatory commissions. Homeowners should continue to track what rebates are available through their local providers, as these can often be combined with federal tax incentives for even greater savings.

The experts here at John Cipollone Inc. can help you find the right rebates and tax credits that match your new high-efficiency HVAC system.

Which Carrier HVAC Products Are Eligible Through December 31, 2025?

Carrier offers several high-efficiency systems that qualify for Section 25C tax credits:

- Heat Pumps — Up to $2,000 in tax credits

- Air Conditioners — Up to $600 in tax credits

- Gas Furnaces — Up to $600 in tax credits

John Cipollone Inc. is a Carrier Factory Authorized Dealer, something we are very proud of, and something that also qualifies us to install this equipment. We can help you choose the right system for your home, and save the most money possible in the process!

What Should You Do About Upgrading Your HVAC System?

Now that you know these tax credits are going away in just a few months, we recommend you assess your HVAC system, and talk to an HVAC professional about upgrading your heating and cooling. If you have had a system installed in the past 7 years, it’s likely that you don’t need a replacement. If it’s older than that, and you were already thinking about making the upgrade, you should contact an HVAC contractor and schedule a free consultation.

If you live in the Havertown area, or any of the surrounding areas, give us a call at (610) 446-7877, or contact us online. One of our comfort specialists will be able to help you decide if it’s time to upgrade your HVAC system, and choose the best system that fits your needs!